I am attracted to deals with Positive Net Cash Flow Before Tax.

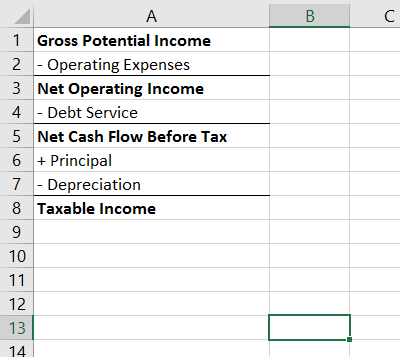

Gross Potential Income (GPI) assumes 100% leased, and we subtract operating expenses to reach Net Operating Income (NOI). Then subtract Debt Service to reach Net Cash Flow Before Tax.

Gross Potential Income:

- Rental Income

Operating Expenses / Assumptions:

- Vacancy (8% – roughly 1 month)

- Management (10% of rental income)

- Utilities (Water, Sewer, Trash, Electricity, Gas – unless any of these are tenant paid)

- Maintenance (1-3% of the property’s value per year depending on age of property)

- Other Variable Expenses

- Insurance (Home Insurance for Renters + Liability Insurance)

- Taxes (Check your county tax website)

- Replacement Reserves / Capex – (5% of rental income)*

- Other Fixed Expenses (HOA)

Notes:

Replacement Reserves – Reserves for a new Roof, Flooring, Windows, HVAC, etc. (Great Explanation Here). My understanding is that replacement reserves have long been argued to be either above or below NOI. From a buyer’s perspective these are real costs and I will include above the line assuming 5% of rental income. Lenders also include these above NOI so I will be consistent from a financing perspective. Sellers might try and put these below NOI. In reality from a cash flow perspective once 6-12 months of rental income has been accumulated in a replacement reserves account than the cash flow may be used for additional investing. Once the replacement reserve drops then continue to deposit 5% of rental income into the replacement reserves account.

Taxable Income – I should note that if Net Cash Flow Before Tax were negative, the loss may be offset substantially via tax loss savings from claiming Depreciation on your Schedule E, but I’d like the property to cash flow from a Net Cash Flow Before Tax perspective. Any tax savings from depreciation will be a bonus!